Lower Inflation with an Asterisk

Peter Bernstein, Chief Economist pbernstein@rcfecon.com, 312-431-1540 x1515

Louise Collis, Senior Economist

December 18, 2025

The Current Situation

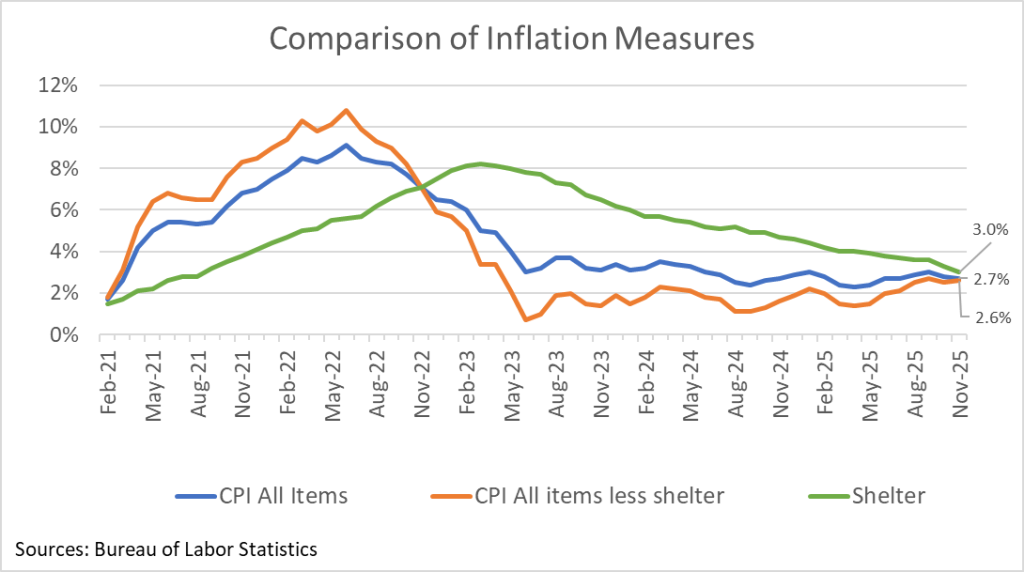

The CPI report for November – there was no October report – showed declining inflation. CPI All Items rose 0.2% over the two months from September to November; year-on-year inflation fell to 2.7%. Core CPI, which does not include food and energy categories, increased 0.2% for the two months and 2.6% for the year.

However, the incompleteness of the report and the fact that the BLS had to make several assumptions regarding key price inputs, makes it hard to draw firm conclusions about the future path of inflation. One key assumption was that rent and owner-occupied rent prices did not increase in October, which was built into their estimate for November prices. Since these two account for over one-third of the total weight of the CPI, it likely biased the overall inflation measure downward. Still, even excluding shelter, inflation measured 2.6% in November, an improvement over September’s rate but still above the Fed’s 2% goal. Future months should provide more clarity on the inflation trend.

RCF’s Inflation Scorecard

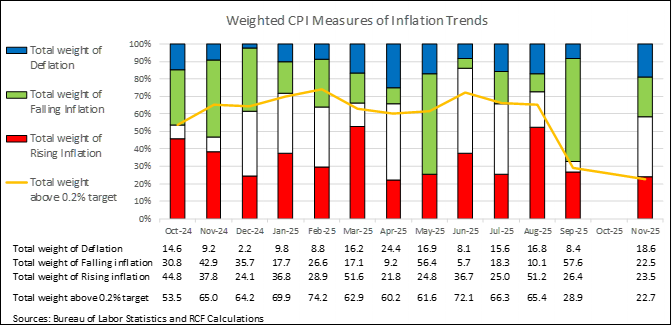

RCF’s Inflation Scorecard is based on analysis of 20 different price series comprising 98% of the total consumer price index. Each of these price series represents a portion of the CPI based on household spending patterns. For example, food purchased for at-home consumption is about 8% of the typical consumer’s budget; it has a weight of 8.04 out of a total index of 100.

Our scorecard presents two metrics to track month-to-month price increases. The first metric is the share of the index for which inflation in the most recent month is rising (greater than the prior month’s inflation) vs. the share of the index for which inflation is falling (lower than the prior month) or prices fell (deflation).

RCF Inflation Scorecard: November 2025

Our first metric shows that 23% of the weighted CPI had falling inflation in November vs September. Another 19% of the weighted CPI saw prices fall in November (deflation). Together 41% of the weighted CPI showed lower inflation or deflation in November, less than average over the last year. 24% of the weighted CPI showed rising inflation in November.

Our second metric shows that 23% of the weighted CPI still has monthly inflation above 0.2%, a monthly figure that corresponds to the Fed’s annual target of 2% inflation. The disconnect between the lower share of items with above-target inflation and the persistent annual inflation above target is evidence of some large ticket items that are well above target, notably housing and housing-related expenses such as utilities. Note that the average monthly rate over the past two months was used to determine whether the CPI category was above or below the target rate of 0.2% per month.

Analysis of Individual Components of the Consumer Price Index

Sources: Bureau of Labor Statistics and RCF Calculations 1. Inflation direction indicates whether monthly inflation in November was higher or lower than monthly inflation in September. Deflation means prices fell in November vs September. The ‘Nov 2025 vs Oct 2025’ column shows the two month change September to November converted to a monthly equivalent for categories that were not reported in October.

Highlights:

- Food at home prices fell 0.2% for the two months, despite continuing increases in meat (up 9% for the year) and coffee (up 19% for the year). Fruits and vegetables are down 0.9% September to November, and dairy is down 1.9% for that period. Food away from home rose 0.5%, and is up 3.7% for the year. Alcoholic beverages at home are up 1.2% for the year, while alcoholic beverages away from home are up 2.6%.

- Owners’ equivalent rent and rent of primary residence are up 0.1% and 0.3% respectively for the two months. The year-on-year rates (3.4% and 3.0%) are still well above the 2% target but coming down slowly.

- Motor fuel prices are up 0.7% for the two months and up 1.1% from a year ago. Household energy is up 1.4% since September, and up 7% from a year ago

- New vehicles rose 0.2% in November, while used cars and trucks are up 0.3% for the month. These two categories were among a small handful of prices that were reported for October. Motor vehicle insurance prices have not been reported since September.

- Public transportation/airfares, down 3.5%, and lodging away from home, down 1.3%, both showed price declines since September.