Inflation creeps up to 3%

Peter Bernstein, Chief Economist pbernstein@rcfecon.com, 312-431-1540 x1515

Louise Collis, Senior Economist

October 24, 2025

The Current Situation

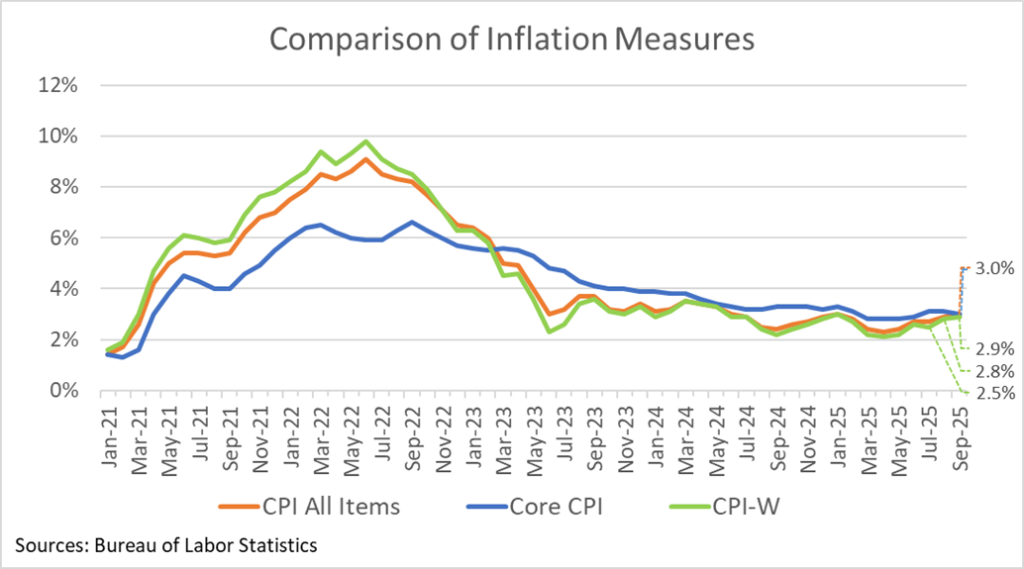

The CPI All Items rose 0.3% in September; year-on-year inflation increased to 3.0%. Core CPI, which does not include food and energy categories, increased 0.2% for the month and 3.0% for the year. The focus this month is on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), used to calculate cost-of-living adjustments (COLAs) which is used to update social security payments and some other pensions and contracts. It came in at 2.8% over the quarter.

Inflation has been rising since it hit 2.3% in April, corresponding to when new tariffs were imposed on many imports. Two forces seem to be at play. A weaker labor market is likely reducing inflationary pressures while tariffs are causing price increases in some sectors. For now, the Fed seems more concerned with the labor market and has begun cutting interest rates. Should inflation continue to rise, they may face difficult decisions in 2026.

RCF’s Inflation Scorecard

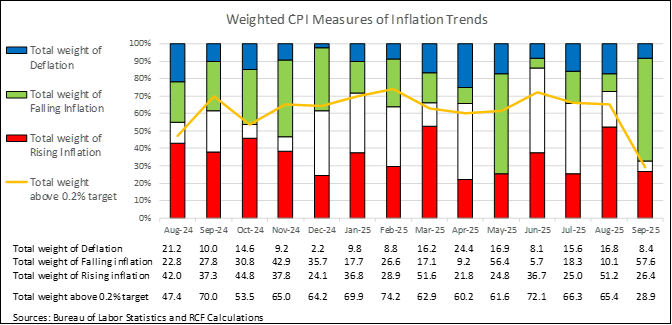

RCF’s Inflation Scorecard is based on analysis of 20 different price series comprising 98% of the total consumer price index. Each of these price series represents a portion of the CPI based on household spending patterns. For example, food purchased for at-home consumption is about 8% of the typical consumer’s budget; it has a weight of 8.04 out of a total index of 100.

Our scorecard presents two metrics to track month-to-month price increases. The first metric is the share of the index for which inflation in the most recent month is rising (greater than the prior month’s inflation) vs. the share of the index for which inflation is falling (lower than the prior month) or prices fell (deflation).

RCF Inflation Scorecard: September 2025

Our first metric shows that 57.6% of the weighted CPI had falling inflation in September vs August. Another 8.4% of the weighted CPI saw prices fall in September (deflation). Together 66% of the weighted CPI showed lower inflation or deflation in September, the second best result in two years. 26.4% of the weighted CPI showed rising inflation in September.

Our second metric shows that 29% of the weighted CPI still has monthly inflation above 0.2%, a monthly figure that corresponds to the Fed’s annual target of 2% inflation. That is the best result since March 2021 when prices started rising. Therefore, it seems that for most products, inflation is under control even though the broader price indices are showing rising inflation.

Analysis of Individual Components of the Consumer Price Index

Sources: Bureau of Labor Statistics and RCF Calculations 1. Inflation direction indicates whether monthly inflation in September was higher or lower than monthly inflation in August. Deflation means prices fell in September vs August.

Highlights:

- Food at home prices rose 0.3% for the month, a big improvement over the previous month’s increase. Alcoholic beverages at home are up 0.3% for the year, while alcoholic beverages away from home are up 4.1%. Food away from home rose 0.1%, but is up 3.7% for the year. While it was a good month for food in general, beef is up 1.2% following a 2.7% increase the previous month and is up 14.7% for the year. Eggs are down 4.7% and dairy is down 0.5% in September

- Owners’ equivalent rent and rent of primary residence are up 0.2% and 0.1% respectively, finally reaching a level where they are no longer contributing to higher inflation. The year-on-year rates (3.8% and 3.4%) are still well above the 2% target but coming down slowly.

- Motor fuel prices are up 4% for the month but down slightly from a year ago.

- New vehicles rose 0.2% in September, while used cars and trucks are down 0.4% for the month and up 5.1% for the year.

- Two other components showed price declines in September: household energy, down 0.7% in September but up 6% from a year ago; and motor vehicle insurance, which is down 0.4% for the month, but is up 58% since 2021.

- Apparel prices were up 0.7% in September following a 0.5% rise in August. That’s where tariffs are likely a factor. Similarly household furnishings are up 4.1% from a year ago.